OrbitHQ

InvestableAI-native SEO system for SMBs and agencies. Multi-engine tracking (Google, Bing, Yandex), AI-powered audits and content, and early AI visibility (ChatGPT, Claude, Grok) in one workflow. Where classic tools show data, OrbitHQ does the work.

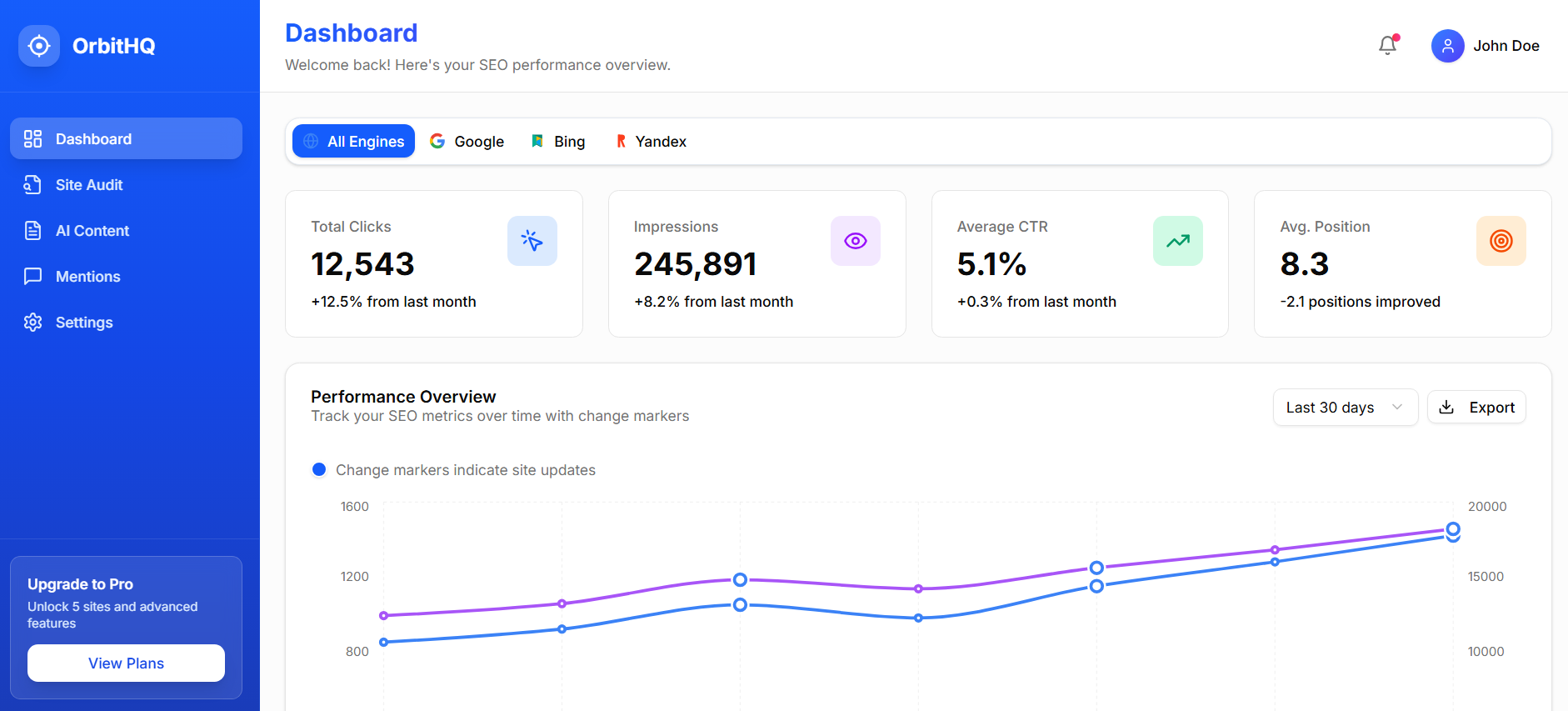

Main Dashboard

Real-time SEO overview with multi-engine tracking across Google, Bing and Yandex

OrbitHQ is an AI-native SEO system for SMBs and agencies.

It combines multi-engine tracking (Google, Bing, Yandex), AI-powered audits and content, and early AI visibility (ChatGPT, Claude, Grok) in one workflow.

Where classic tools like Semrush and Ahrefs show you data, OrbitHQ focuses on doing the work. It analyzes pages, suggests changes, writes content, and helps teams execute.

Recent news that Adobe is acquiring Semrush for about $1.9B confirms that search visibility and SEO platforms are strategic infrastructure, and that there is room for a new, AI-native generation of tools.

OrbitHQ is an SEO engine that runs your growth. It tracks your visibility across engines, tells you what to fix, and helps you produce better content, all in one place.

Ready to Transform Your SEO?

Join 20+ companies already on our waitlist. Get early access and exclusive launch pricing.

Investment Information

Comprehensive details for potential investors and partners

Roadmap

- →Short term (MVP to early customers): Finalize core dashboard, ship reliable GSC integration and basic Bing/Yandex coverage, deliver AI audit and suggestions, launch content writer with brand voice support, open Pro plan with 14-day trial

- →Medium term (scale to thousands of users): More robust multi-engine tracking including international markets, better AI models and routing with fallbacks, stronger reporting with client-friendly summaries, improved onboarding and in-app education, partnerships with agencies and accelerators

- →Long term (position for category leadership or acquisition): Deep integration with marketing and analytics stacks, team-based workflows and role-level access, APIs for larger companies, visibility layer tracking both search rankings and AI-generated answers at scale

Market Analysis

Total Addressable Market (TAM)

~$127B global SEO and search marketing spend (2025, including tools, services, and related software)

Market Segments

- • SMB SEO (e-commerce and local businesses)

- • Agencies that lose ~20 hours per week per strategist to manual SEO work

- • AI-powered search visibility, as brands care how they appear in both classic SERPs and AI answers

Market Trends

Search is fragmenting across Google, Bing, Yandex and AI assistants. Marketers are under pressure to do more with smaller teams. Tools that only show metrics are losing ground to platforms that automate execution. With the Semrush acquisition, larger suites like Adobe Experience Cloud are buying visibility tech instead of building it. OrbitHQ sits between classic SEO tools and AI assistants as an AI-native SEO system.

Value Proposition

- →See where you stand: Multi-engine visibility across Google, Bing, and Yandex. Clean dashboards using GSC and other data sources. Clear sense of what is working and what is not.

- →Know what to do next: AI audits for any URL. Actionable change suggestions that point to specific fixes. Task-style guidance that non-experts can follow.

- →Produce SEO content that matches your brand: AI-generated outlines and blog posts. Brand voice learning from sample URLs or pasted content. Keyword and structure suggestions based on real performance.

- →Outcome: OrbitHQ aims to save teams and agencies 20 hours per week in manual SEO tasks and deliver at least double-digit lifts in impressions and CTR over the first months of use, measured against their own baselines.

Business Model

Pricing Tiers

- • Free: 1 site, limited audits, basic GSC tracking, limited AI content generation

- • Pro — €79/month: Up to 5 sites, full multi-engine tracking, AI audits and change suggestions, AI content writer with brand voice, task system and basic reporting, 14-day free trial (no credit card)

- • Agency — €199/month: Up to 20 sites, client workspaces and white-label reports, collaboration features, more generous AI limits, priority support, no free trial (request access or demo-based onboarding)

- • Enterprise: Custom contracts once the product and traction justify it

Revenue Goals

- • The pricing undercuts typical Semrush configurations for small teams, while giving agencies an attractive per-client cost basis

Market Analysis

Target Customers

- • E-commerce SMBs (60% churn, need affordable SEO)

- • Local businesses (need affordable SEO)

- • Small businesses (need affordable SEO)

- • Medium businesses (need affordable SEO)

- • Large businesses (need affordable SEO)

- • Enterprise businesses (need affordable SEO)

- • Agencies (lose 20h/week on manual SEO tasks)

Competition

- • Semrush ($139/mo, enterprise focus, no AI mentions)

- • Ahrefs ($99/mo, no Yandex/Bing tracking)

- • Outrank.so (AI content, no unified tracker)

Technology Stack

Current Stack

- • Next.js / React front-end

- • TypeScript

- • AI providers (OpenAI as primary, with planned fallbacks)

- • Chart.js for visualizations

- • GSC and other search data connections where possible

- • Hosted on modern cloud infra with a focus on low-latency dashboards

Future Stack

- • Multiple AI model support for resilience and cost control

- • Deeper data connections for agencies and e-commerce

- • APIs and webhooks for enterprise users

Team

Current Team

- • Founder: Solo developer and SEO operator, ex-agency owner with €67K per month revenue experience. Strong mix of technical capability and market understanding

Future Team

- • Growth and marketing-focused generalist (to help with customer acquisition and content)

- • Customer success/onboarding for agencies once revenue supports it

- • Advisors and external partners can be added as the company progresses through the pre-seed and seed stages

Risk Analysis

Risk: Competitive market

Mitigation: There are many SEO and AI content tools. OrbitHQ mitigates this by combining SEO visibility, AI automation, and workflows in a single platform, not a single feature.

Risk: Solo founder

Mitigation: Solo founding teams are riskier by default. Mitigated by strong execution speed, a track record in SEO, and early hiring of growth and customer-facing roles once funding lands.

Risk: Fast moving AI landscape

Mitigation: Mitigated by multi-model approach and a focus on workflow, not model novelty.

Risk: Dependence on search platforms

Mitigation: Mitigated by diversifying across Google, Bing, Yandex and AI assistant visibility, rather than relying on one engine.

Development Timeline

MVP Completion: Current - December 16, 2025

Tasks

- • Complete MVP development

- • Finalize core dashboard and multi-engine tracking

- • Polish AI audit and content generation features

- • Prepare for first user onboarding

Early Users: December 16, 2025 - Q1 2026

Tasks

- • Onboard first beta users and gather feedback

- • Iterate on core features based on user needs

- • Build case studies with measurable results

- • Refine onboarding and user experience

- • Start content marketing and community outreach

Q2–Q3 2026

Q4 2026 - Q1 2027

Q2 2027 - Q3 2027

2028–2029

Strategy & Metrics

Exit Strategy

The strategy is to build OrbitHQ into a default choice for SMBs, startups, and agencies that need real SEO outcomes without running a complex stack of tools. Short term: become the easiest way to get multi-engine visibility and AI-assisted SEO execution. Medium term: deepen adoption with agencies and internal marketing teams. Long term: be a natural acquisition target for larger marketing suites, analytics platforms, or AI companies that want an AI-native SEO layer. Adobe's move on Semrush at roughly $1.9B shows there is clear appetite for visibility platforms that sit close to search and AI. OrbitHQ is positioned as the lean, fast, AI-native alternative that can grow into that same gravity well from the bottom up.

Key Metrics

Ready to Invest?

Join the OrbitHQ journey and be part of the next big SEO platform